Learn ways to help support

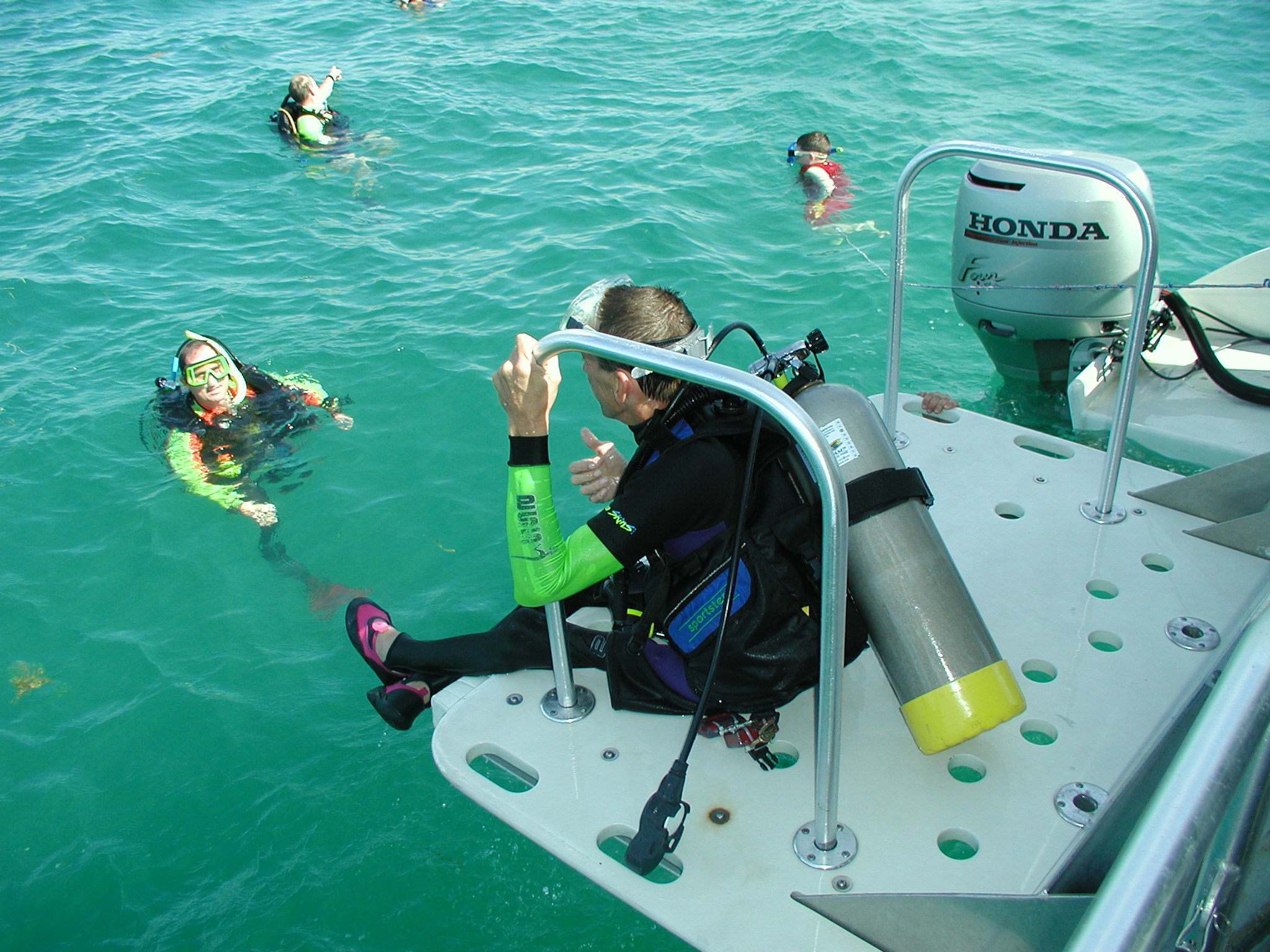

Changing the perception of

what it means to be Disabled…

Learn the many ways you can be a part of Operation Blue Freedom and the Triple World Record from Home!

…using the water to heal.

Gifts of Stocks or Bonds

Appreciated securities such as stocks, bonds or mutual fund shares are often contributed to Poseidon Handicap Scuba Adventures PHSA). As a supporter of Handicap Scuba Adventures, you may wish to consider the benefits of making a gift of appreciated securities, particularly at the end of the year.

This simple, effective method of giving could double your tax benefit:

Suppose, for example, that you purchased 100 shares of XYZ stock at a cost of $2,000 in 1985. Today, your XYZ shares are worth $10,000. If you sold all your XYZ shares, you’d owe a capital gains tax of 15% on the $8,000 gain, or $1,200.· If you itemize your return, you can receive an income tax charitable deduction for a contribution of appreciated securities; those owned for longer than a year are deductable for their full fair market value. You also avoid capital gains tax.· By donating the $10,000 of XYZ stock to Poseidon Handicap Scuba Adventures, you could save up to $2,500 in income taxes and $1,200 in capital gains taxes. This is far more than you would save by donating cash or selling the securities and donating the cash proceeds.

Gifts of Securities

If you have the actual certificate, you can mail the un-endorsed certificate and a signed stock power (in separate envelopes) to our Planned Giving department. The gift date is determined by the postmarks on the envelopes. Most financial institutions can provide stock powers, or, if you prefer, we will send one to you.· The fastest and easiest way to make a stock gift is to have your broker perform an electronic transfer. He or she will need the following information:

Account Name: Poseidon Handicap Scuba Adventures

Account #: Individual Brokerage 4565-4895

Brokerage: E Trade

Important: please be certain to notify us when you’ve made a gift of securities.

Gifts of Closely Held Stock

Provided you have owned it for more than one year, a gift of closely held stock may enable you to make a more significant gift than you otherwise could, while generating an income tax charitable deduction equal to the fair market value of the stock on the date of the transfer.

By making a gift of stocks, capital gains taxes are avoided. So long as there is no binding obligation on PHSA to accept any subsequent purchase offers nor any specified price at which PHSA must sell, PHSA may entertain offers from family members or the corporation issuing the stock to purchase the transferred shares.

Make A donation

If you are interested in helping to continue to help the disabled through PHSA please send us a message and one of our team members will reach out to you.